EV Dealer Package

Project Overview

Client: Ansira / Sincro

Product: Electric Vehicles package of information and product(s) for display on automotive dealership websites.

Team: Product Owner; UX Designer; Software Engineering Team

Role: UX Designer – Research, wireframe, design, interactive mockups

Timeline: 8 Months

Steps: Project Intake; Research; Wireframes; Mockups; Retrospective

Summary of Requirements

The Electric Vehicles solution project was driven by a need to stay competitive in the automotive website market. There was a need for an encompassing EV solution coming from client feedback as well as a need to anticipate the market in the upcoming years. This project would aim to build a package of information and products that dealers could feature on their website to expose customers to EV information and increase the demand for electric vehicle sales.

The expected project direction was still vague at the start and would rely on the initial research phase to expose what exactly would be needed.

Pre-Build

Project Scope | Timeline | Research

After gathering initial requirements a project scope of work & timeline were generated for the research phase. The research portion would include initial user research, a content audit of competitor offerings and user interviews. The information would be aggregated and summarized into a package of suggested solutions. This package was presented to our product owners and at that point we would decide on the future direction of the project.

User Research Data: User data was collected from dealership interviews, internal metrics, dealer feedback and many publicly available studies surrounding the use of electric vehicles including these from: Ricardo strategic consulting, JD Power, KBB, and Coxauto. Overall this was able to give us a good picture of what the extisting EV customer looks like as well as a future projection of the average shopper in 2025.

Who Is The Customer

ESTIMATED SHOPPER (2025)

Age: 25-55

Sex: Male (70%)

Income: $92,000+

Ethnicity: White

Education: College Degree or higher

Political View: Neutral – customers are equal from both parties

Location: Likely a Blue State

Housing: Owns their own home

Weekly Commute: >150mile/week

The average estimated shopper in the next few years will look similar to current owners; with the biggest changes affecting age range and weekly commute distance. While it is expected that the adoption of EV vehicles will increase (up to 40% of all light duty vehicles by 2030), and the customer base will broaden, price and awareness are the currently the bottlenecks for EV vehicles.

*OEM’s will be targeting customers that are “Somewhat likely” to choose EV and trying to convert to potential buyers.

What are they looking for

ESTIMATED SHOPPER (2025)

Potential customers are more likely to purchase when they have a good background knowledge about EVs. General education questions involve understanding the difference between EV and other fuel types (BEV, PEV, Hybrid, etc); how they work, and what vehicles are available.

Another bucket of interest is the capability and reliability of EV’s. What is the mileage range, can I drive in a city or road-trip? What is the towing & cargo capacity? What does maintenance and lifetime cost on an EV look like?

Financial questions play a big part in a shoppers decision. Understanding payment options, tax credits and vehicle related costs such as insurance & maintenance can help a customer become a buyer.

Charging concerns are quickly becoming less of a roadblock, but still a common concern in potential buyers. Understanding how to find a charging station and how to charge at home are the main questions.

Other Findings

ADOPTION INCREASES WITH EXPOSURE

Customers who have never been in an EV were 11% “very likely” to buy an EV.

24% “very likely” if they have been a passenger.

34% “very likely” if they have driven an EV.

Dealer education to the customers is cited as the #1 factor in a customer choosing an EV (80% buyers).

*71% of dealers feel somewhat or not at all prepared to sell more EV’s.

Shoppers don’t know there are EV options out there. Most people know Tesla does, but very few know that Ford, Nissan and Chevy sell EV’s.

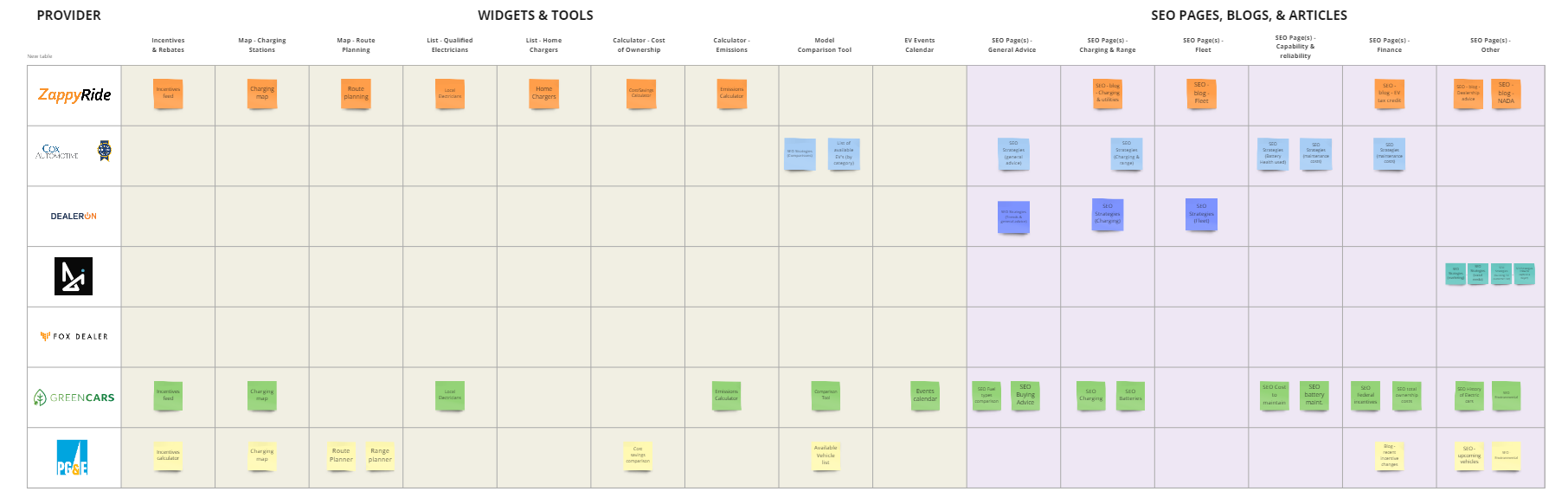

Comparative / Competitive Analysis: For this phase of research I began looking at our competition as well as other entities outside of the website provider network to see what products, services and information were being offered. This information was broken into 2 buckets – informational, such as SEO pages, blog listings and articles; the other bucket was interactive tools that offered concrete data such as charging maps, comparison tools and route planners.

Research Summary: Education and exposure to EV information most important factor in boosting EV Sales. Dealers need to be armed with information on their website which can be referenced by employees; that will also improve search rankings for potential EV Shoppers.

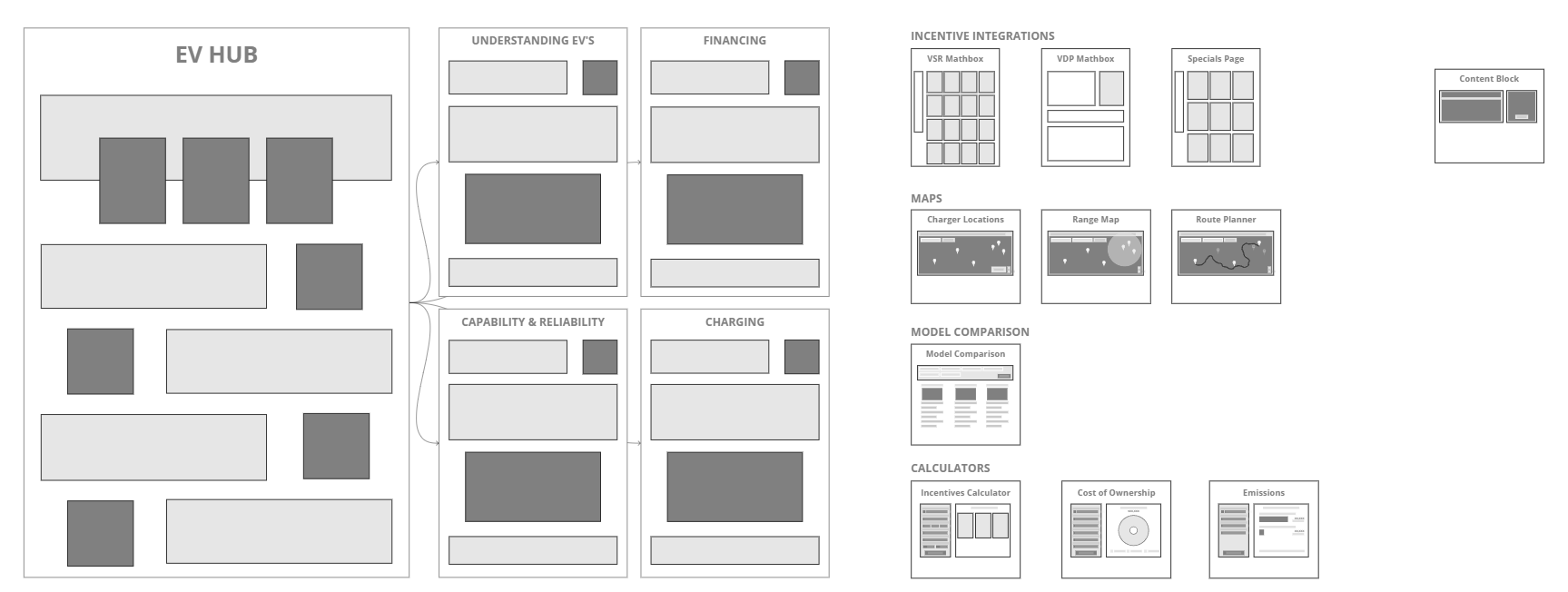

SEO pages should be created covering the most common shopping questions: general information and advice regarding EV’s, Capability and Reliability, incentives and financial options, and Charging concerns. Additionally a “tool kit” that compliments the informational strategy would be highly beneficial.

The most popular widgets are incentive calculators, charging station maps, and model comparison tools. Next most commonare an emissions calculator, cost of ownership calculator and more map functionality (route planning and range indicator). While lower in popularity, a potentially helpful tool set is the list of qualified electricians and available home chargers. These tools would help new EV customers prepare their homes for their EV purchase. It may be worth trying to partner with a provider like Plugstar for these shopping tools or build them at a central location (not dealer-by-dealer basis).

Wireframes & Mockups

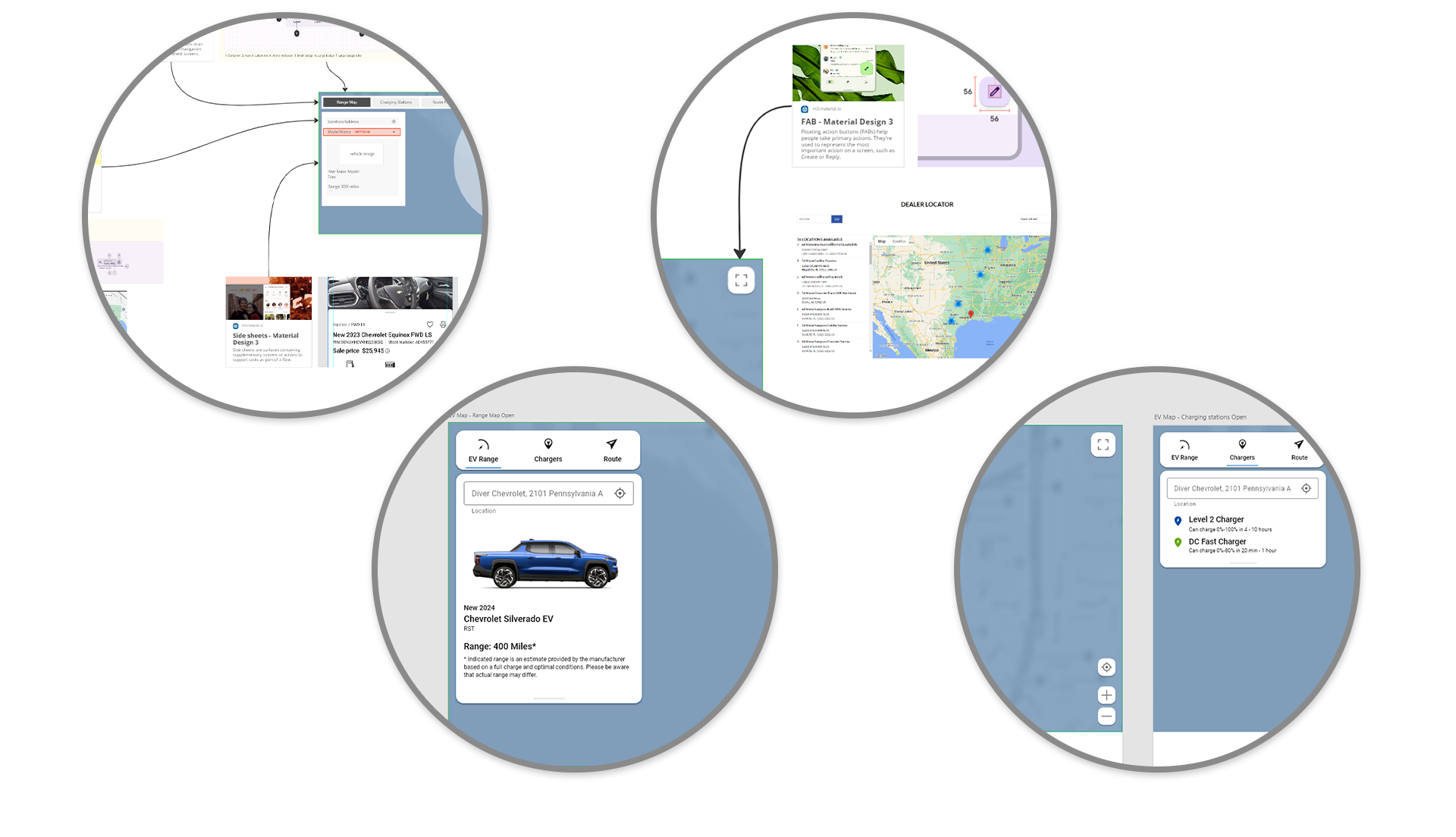

Collaboration with our engineers and product owners lead to the decision to proceed with the SEO pages as well as an interactive map widget that would allow customers to see the range of their electric vehicle, nearby charging stations and plan a route with charging stations highlighted along that route. Some additional research was done in this phase in collaboration with the PO & engineers to determine the sources for the necessary data, which API’s we could use, a partnership with Woolpert for google map integration, and costs of outsourcing this project to another provider.

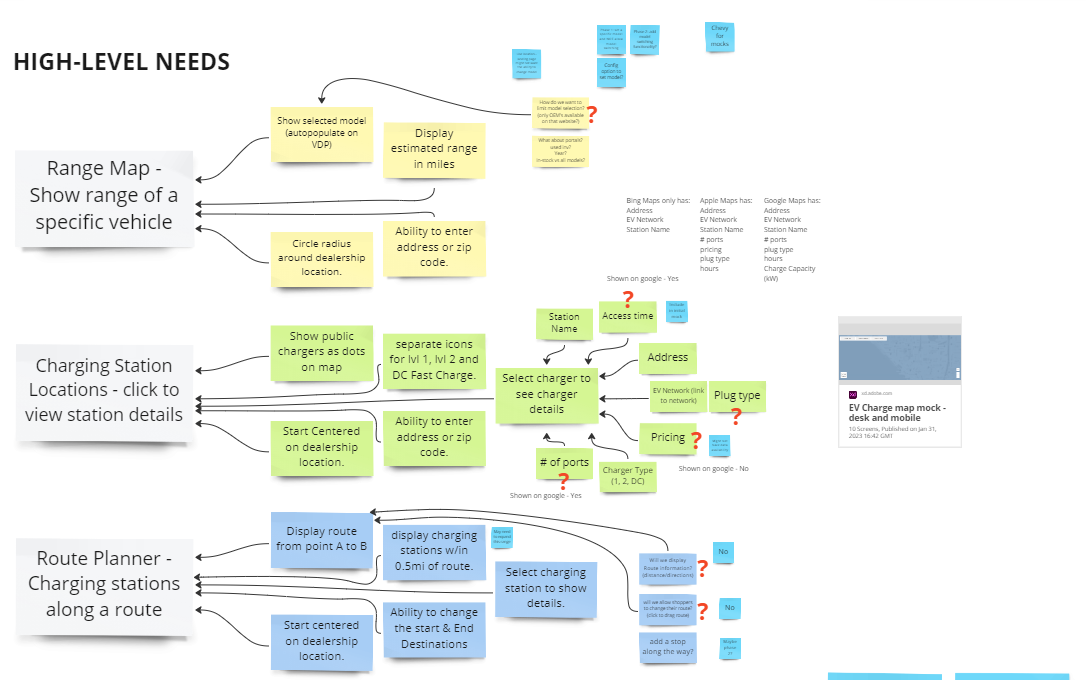

The EV pages were handed off to our SEO team who generated an in-depth analysis of the exact content needed for each of those pages. While that was in flight, I focused on the map product. Using the data found during the research phase we began determining exactly what features would be needed and how they needed to be nested.

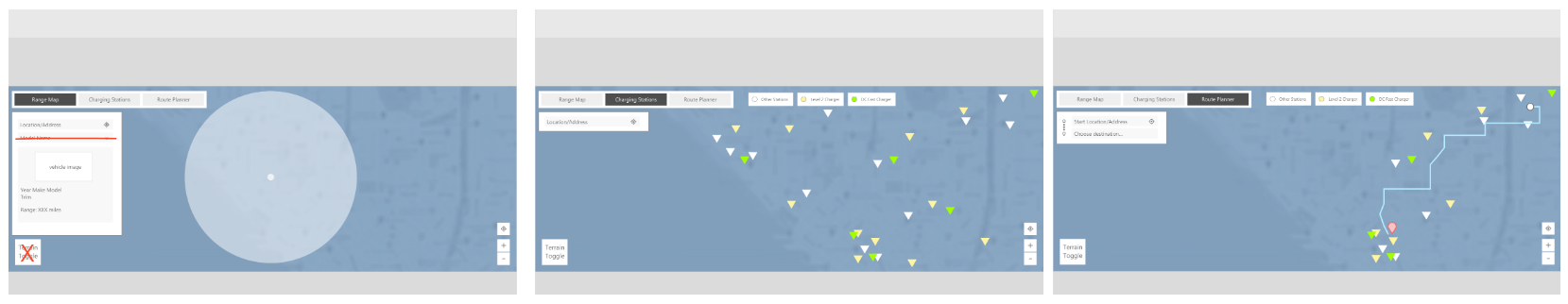

The map would include 3 main products – a range map, to show the max driving range determined by which vehicle was selected; a charging station location map which would allow users to see all the charging stations in their area and click into each one to see details about it; and a route planner, allowing customers to plug in 2 points, generate a route between those points, and see all the charging stations along that route.

After determining functionality and layout, work began on the final interactive mockups in Adobe XD.

Final Product

This product has been announced, but not yet launched. Final images coming soon!